The world of banking is changing every day as we know it. The Internet has had a big impact on banking and transactions. A term many of us have heard of and don’t know the meaning of it is “neobanks”. Neobanks are the future of banks and finance. That makes it important to know what is a neobank and how neobanks work.

What Is A Neobank?

A neobank, also known as a digital-only bank or online bank, is a type of bank that exclusively operates over the internet, without any physical bank branches. Neobanks offer banking services primarily through mobile and online applications rather than traditional physical locations. This allows them to operate with significantly lower overhead costs compared to traditional brick-and-mortar banks.

Without the expensive infrastructure of maintaining a vast network of branches and ATMs, neobanks can pass on greater cost savings to customers through features like no monthly account fees. However, neobanks also have fewer regulatory requirements than traditional banks which provide customer deposit insurance.

What Types Of Services Do Neobanks Offer?

While their operational models differ, neobanks generally offer consumers similar core banking services as traditional banks. This includes checking and savings accounts, person-to-person payments, debit cards, bill pay functionality, and options for setting up automated savings plans and budgets.

Beyond basic account management, some neobanks are increasingly expanding their offerings into new product categories. This includes increased focus on mobile-first money management tools, peer-to-peer lending/investing opportunities, cryptocurrency trading, and open banking integrations powered by application programming interfaces (APIs). The streamlined digital experiences and lack of fees enable neobanks to attract customers frustrated with the often outdated and expensive nature of traditional banking.

How Do Neobanks Make Money?

Without the substantial overhead costs associated with maintaining a large physical branch network, neobanks can operate with far lower expenses as an exclusively online business model. This allows them to offer many core services to customers either free of charge or at reduced prices compared to legacy banks. However, neobanks still need to generate revenue to remain profitable.

Common methods involve earning interest spreads on loans and deposits, collecting interchange fees from customer debit card transactions, charging optional subscription or premium account fees, and taking small cuts of revenues from financial products integrated through their platforms. Additional revenues may come from partnerships, referrals for services like bill pay or lending, and selling anonymized user data for analytics purposes.

How Secure Are Digital Banking Services?

Security is of paramount importance for any financial institution, but neobanks face unique challenges in securing customer data, funds, and digital banking activities without physical safeguards like vaults. Leading neobanks implement robust security measures including bank-grade encryption for all transmitted data, multi-factor authentication for login verification, automated monitoring for fraudulent account access, and protections for customer funds storage via electronic wallets separated from their operating balances.

Customers should also use strong and unique passwords, keep apps updated, monitor accounts frequently, and enable optional email/text alerts for transactions. While digital-only operations increase certain cyber risks versus branch-based banks, top neobanks invest heavily in technology and partnerships with specialist companies to ensure security is maintained as digital banking adoption grows.

What Are The Risks And Difficulties Faced By Neobanks?

While digital-only models reduce overhead costs, they also present unique risks for neobanks. Large upfront investments are required to develop core banking infrastructure and compliance controls from scratch. Sustained profitability may depend on achieving significant customer scale. A sparse physical presence makes resolving account issues or fulfilling special requests difficult.

Neobanks also face greater cybersecurity risks without physical control of assets or transaction authentication mechanisms like chip and PIN cards. Relying on third-party service providers to assist core operations introduces dependency risks. Without long operating histories or deposit insurance, some customers may perceive neobanks as less secure than established brands. Neobanks must prove their services through superior experiences while mitigating new risks accompanying the digital transformation of banking.

How Do Neobanks Approach Regulations?

As disruptors of traditional banking models, neobanks must navigate a complex regulatory landscape not designed for digital-only operations. Areas of focus include banking licenses, anti-money laundering oversight, technology risk management, data privacy/protection rules, taxation, and capital/liquidity requirements.

Leading neobanks proactively engage regulators to operate within compliance. Some initially offer payment/prepaid services before applying for restricted/full banking charters allowing deposit-taking. Others form partnerships with licensed banks to leverage existing registrations. Financial authorities worldwide are steadily clarifying rules to encourage responsible fintech innovation. Solid regulatory foundations help build long-term trust for neobanks as new competitors but maintaining rules focused on consumer protections presents ongoing challenges.

What Does The Future Hold For Neobanks And Digital Banking?

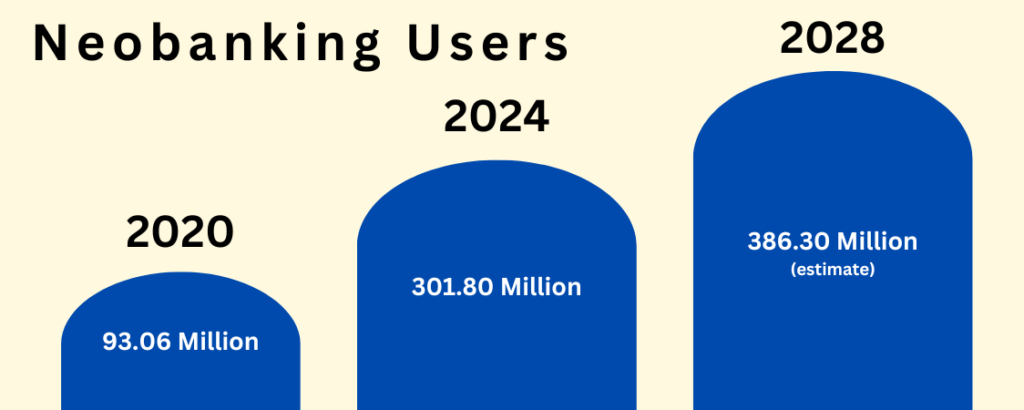

Alongside ongoing regulatory framework adaptations facilitating responsible innovation, several factors indicate growing opportunities for neobanks worldwide. Younger consumers rapidly adopting smartphones will increasingly expect banking functionality seamlessly integrated into their digital lives.

Advancements in fintech like AI, biometrics, and data analytics allow highly customized services to surpass legacy banks. As neobanks scale customer bases and brand recognition, more will offset startup costs through revenue streams while maintaining lower operational costs than traditional branches incur. Strategic partnerships between fintech startups and incumbents promise “banking-as-a-service” opportunities. And greater emphasis on open banking through APIs enables deep integrations benefitting both end-users and neobank/fintech ecosystems. All signs point to further transformation and mainstream adoption of neo-banking models worldwide in the coming years.

Conclusion | What Is A Neobank

Neobanks have emerged as promising digital disruptors to traditional banking through their internet-first approach to lowering costs. Continued focus on security, strategic partnerships, and meeting evolving regulatory expectations will determine those achieving long-term viability by offering significant consumer value propositions. As digital natives enter their prime consumer years, neobanks are well positioned to capitalize on new expectations for how financial services should seamlessly integrate with lifestyles increasingly conducted online. Those effectively executing omnichannel strategies inclusive of both web/mobile and emerging innovations stand to rapidly gain new customers worldwide.