When constructing an investment portfolio, one strategy involves including blue chip stocks, which generally refer to large, well-established companies with a long history of stable earnings and dividend growth. These prominent businesses are seen as being very reputable, with strong brand recognition and leading market positions. This article will provide an in-depth look at blue chip stocks and examine their key characteristics and role in diversified portfolios.

What are Blue Chip Stocks?

Blue chip stocks are the shares of prominent large companies that have a long track record of success. They typically have sustained high dividends and consistent profits over many decades, which gives investors confidence in their financial resilience through changing economic conditions. Blue chip companies are distinguished by their strong balance sheets and competitive advantages in their industries that help protect profits and market share through downturns. Their size also gives them greater financial flexibility to weather challenges better than smaller firms.

Characteristics of Blue Chip Companies

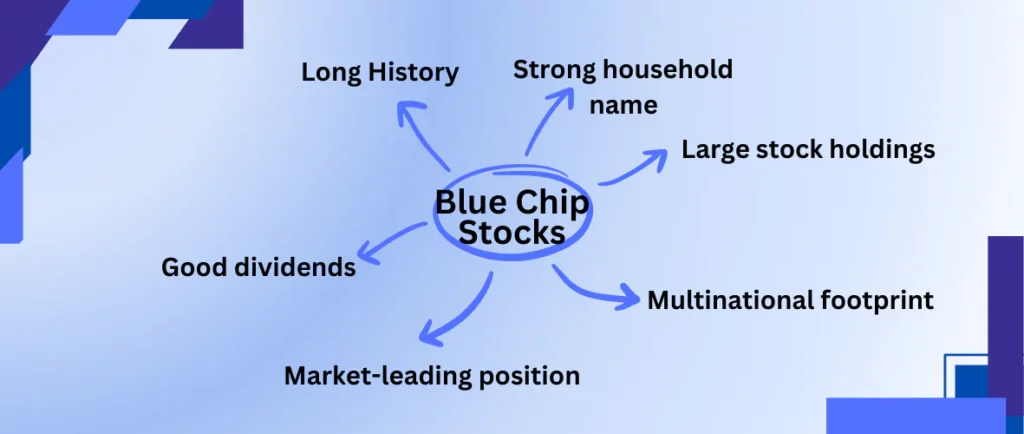

Some distinguishing qualities common among blue chip stocks include:

- Multinational footprint with global brand recognition and diversity of revenue streams across regions.

- Market-leading position, strong brand, significant investments in research/development.

- History of 20+ years of consistent dividend payments and increases each year.

- Strong household names with well-known, long-sold products and services worldwide.

- Top holdings in major stock market indices, signaling large size and stability.

- Blue chip dividend payers often maintain payout ratios below 50% of earnings.

- High credit ratings enable low-cost debt financing for strategic investments.

- Higher than average returns on equity capital and profit margins supported by economies of scale advantages.

Why Do Investors Favor Blue Chip Stocks?

Both individual and institutional investors are drawn to well-established blue chip stocks because of their stable growth, predictable returns, and lower risk profile. When compared to smaller businesses that depend on more limited products or markets, their well-known brands ensure that demand and cash flows will endure over time.

With trillions of dollars pouring through major indexes, blue chips are also essential portfolio holdings due to their sheer magnitude. Their consistent dividend income boosts overall returns, particularly in times when stock values are stagnant. All things considered, blue chips strike a compromise between return-seeking goals and the downside risk protection that wise long-term investors value.

Top Worldwide Blue Chip Companies

Prominent worldwide blue chip companies that are frequently mentioned include those based in the United States, such as Apple, Microsoft, and Johnson & Johnson, as well as multinational behemoths that represent a variety of industries and leverage scale advantages globally, such as Nestle, Royal Dutch Shell, Toyota Motor Corp, Novartis, and HSBC Holdings.

Some companies stand out even from the biggest ones because of their steady industry-leading profits, dividends, strong balance sheets, and senior leadership that keeps them competitively advantaged for decades even in the face of changing economic conditions. The enduring popularity of these famous, well-established blue chips continues to strengthen investor loyalties.

Advantages of Including Blue Chips in Portfolios

Incorporating blue chip stocks enhances long-term investment outcomes through several crucial benefits:

- Provides a stable core holding generating a reliable dividend income stream.

- Supports portfolio during downturns given stronger balance sheets weathering crises better.

- Acts as a hedge against inflation through pricing power passing higher costs to customers.

- Remains an indispensable sector in retirement accounts needing drawdown protection.

- Serves as a source of funds during drawdown periods by trimming shares gradually.

- Offers tax-advantaged treatment of qualified dividends reinvested or received.

- Allows participation in global economic prosperity leveraging worldwide operations.

Overall, the tried and tested nature of prominent blue chips furnishes ballast against severe volatility while steadily rewarding loyal shareholders. Their prominence signifies durability unlikely to disappear suddenly, assuaging concerns around reliability versus startups.

Does Quality Come at a Cost?

While blue-chip quality has advantages, its growth is usually a little slower but more steady than that of smaller businesses that can innovate quickly or take advantage of niche opportunities. Similar to their mid-sized competitors, their massive size could make it difficult for them to pivot quickly when the industry changes. When economies or sectors cool off after extended periods of outperformance, valuations also tend to plateau, necessitating patience amid sideways trade. Nonetheless, wise long-term investing prioritizes total returns that are balanced with low volatility, which blue-chip companies have consistently provided in the past.

Conclusion

Blue chip businesses are essential investments for disciplined and cautious investors who aim to strike a balance between capital preservation and return objectives. Their famous reputation is the result of their constant ability to produce financial performance, innovation, and leadership throughout decades, if not centuries, in a variety of global economic environments. Strong balance sheets, consistent dividend payments, and brand supremacy make it possible to weather unforeseen challenges better than others. When carefully combined over cycles, a group of reliable blue chips that serve as the foundation of globally diversified, balanced portfolios is an excellent way to achieve retirement planning and wealth creation objectives.